January 20, 2016

Number of stopped-out trades as a custom metric

For the purpose of counting trades closed by particular stop we can refer to ExitReason property of the trade object in the custom backtester. The custom backtest formula presented below iterates through the list of closed trades, then counts the trades, which indicate exit reason = 2, that is stop-loss.

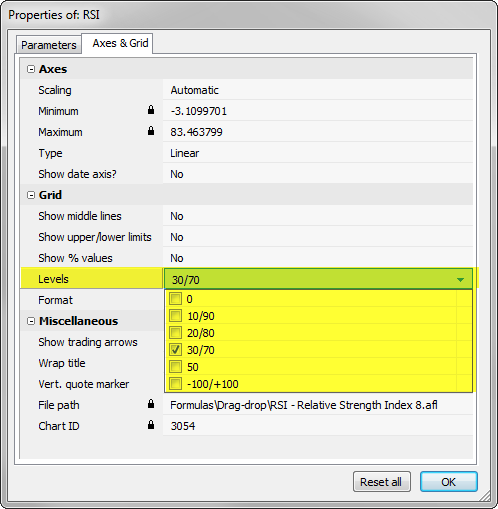

The following values are used for indication of the particular exit reason:

- normal exit

- maximum loss stop

- profit target stop

- trailing stop

- n-bar stop

- ruin stop (losing 99.96% of entry value)

SetCustomBacktestProc( "" );

/* Now custom-backtest procedure follows */

if( Status( "action" ) == actionPortfolio )

{

bo = GetBacktesterObject();

bo.Backtest(); // run default backtest procedure

// initialize counter

stoplossCountLong = stoplossCountShort = 0;

// iterate through closed trades

for( trade = bo.GetFirstTrade(); trade; trade = bo.GetNextTrade() )

{

// check for stop-loss exit reason

if( trade.ExitReason == 2 )

{

// increase long or short counter respectively

if( trade.IsLong() )

stoplossCountLong++;

else

stoplossCountShort++;

}

}

// add the custom metric

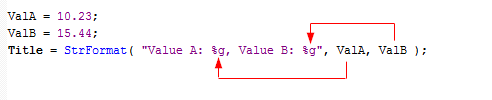

bo.AddCustomMetric( "Stoploss trades", stoplossCountLong + stoplossCountShort,

stoplossCountLong, stoplossCountShort, 0 );

}

Buy = Cross( MACD(), Signal() );

Sell = Cross( Signal(), MACD() );

Short = Sell;

Cover = Buy;

ApplyStop( stopTypeLoss, stopModePercent, 2, 1 )

Filed by Tomasz Janeczko at 3:16 pm under Custom Backtest

Filed by Tomasz Janeczko at 3:16 pm under Custom Backtest

Comments Off on Number of stopped-out trades as a custom metric